Save on Parts and Service Through June

Rush Truck Centers Maintenance Plans

Planned maintenance made simple.™

Enter to Win the

Last 2025 Peterbilt Model 389

International S13 Demo Units Building Now

REQUEST YOUR NO-COST, NO-OBLIGATION DEMO SPOT TODAY

More than a dealer network, Rush Truck Centers is the premier solutions provider for the commercial vehicle industry. With more than 140 Rush Truck Centers dealerships across the U.S., no one can match our network reach and scale. We provide our customers an integrated, one-stop approach to the service and sales of new and used trucks and commercial vehicles, aftermarket parts, service and collision repair capabilities, alternative fuel systems, vehicle technology solutions, and a range of financial services including financing, insurance, and leasing and rental options. Since 1965, we've earned our reputation for excellence, fairness, positive attitude and solutions that exceed customer expectations. That’s why we can say with confidence; when it comes to trucking, no one offers you more.

Upcoming Events

EXPECT A BETTER WAY TO PURCHASE PARTS

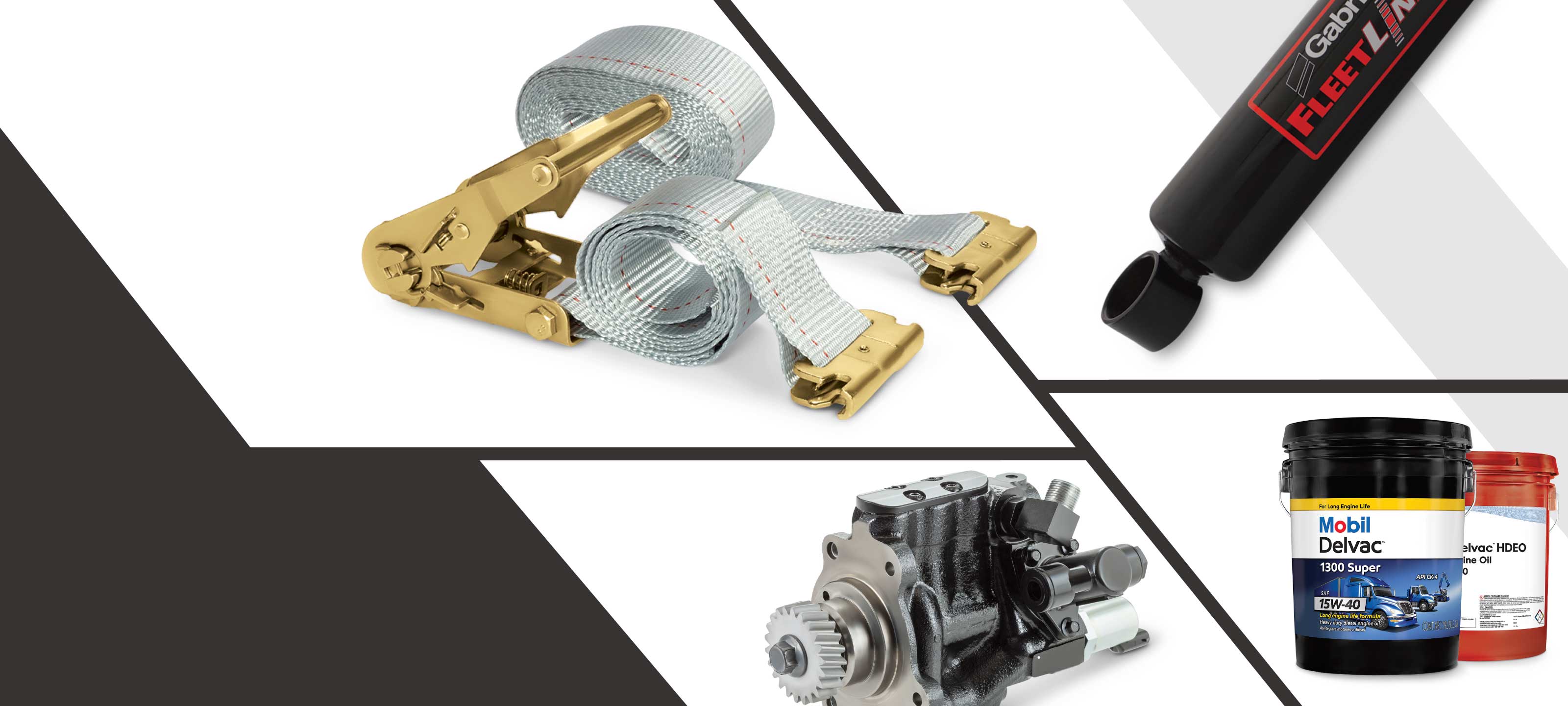

We have the parts you need, when you need them. Rush Truck Centers offers a breadth of products unmatched in the industry, including $325 million in all-makes parts and accessories in our inventory. Whether you need parts for light-, medium- or heavy-duty vehicles, we can help you get the right parts the first time — at competitive pricing with fast and convenient delivery.

And our Parts Connect® online parts ordering system makes it easy to search for parts, check availability, place an order, and arrange pickup or delivery — anywhere, anytime.

EXPECT A SMOOTH SERVICE EXPERIENCE

Our complete maintenance and repair solutions are designed to increase your uptime and lower your operating costs. When your vehicle arrives at one of our service locations, we go to work to quickly identify your immediate service needs and provide accurate time and cost estimates for any needed repairs. We even offer after-hours service and 24/7 roadside assistance at select locations.

While your truck is in our shop, you'll have 24/7 access to Service Connect™, our online service communication system that allows you to manage repairs, communicate with our service teams and see where your vehicle is at in the repair process.

Expect Ultimate Customer Satisfaction

At Rush Truck Centers, the customer is the boss. We believe real customer support is about being accessible on your terms. That's why our RushCare Customer Support Team is available 24/7 to provide technical support, schedule service, dispatch roadside assistance or help you find the nearest Rush Truck Centers location.

Plus, our RushCare Service Concierge Team can proactively manage service and repairs for your vehicle by offering priority vehicle monitoring, technical support and expedited vehicle repairs as well as vehicle recall and campaign management services.

CONTACT RUSHCAREExpect a Diverse Inventory

Rush Truck Centers All-Makes Parts Catalog

Our 164-page All-Makes Parts Catalog offers more than 16,000 popular all-make parts with descriptions and applications, full-color product images, tech and product tips and extensive cross-references. View our catalog online or pick up a printed copy at any Rush Truck Centers location nationwide to browse products from the quality brands you know and trust for all makes and models of trucks and trailers.

Work for the Best, With the Best, On the Best

We're looking for the best and brightest technicians and mechanics to join our team. Rush Truck Centers is a leader in the trucking industry and the largest commercial dealership network in North America. We offer exceptional compensation and benefits, and a host of perks that make Rush Truck Centers the premier employer for diesel technicians and mechanics.

EXPLORE TECHNICIAN CAREERS